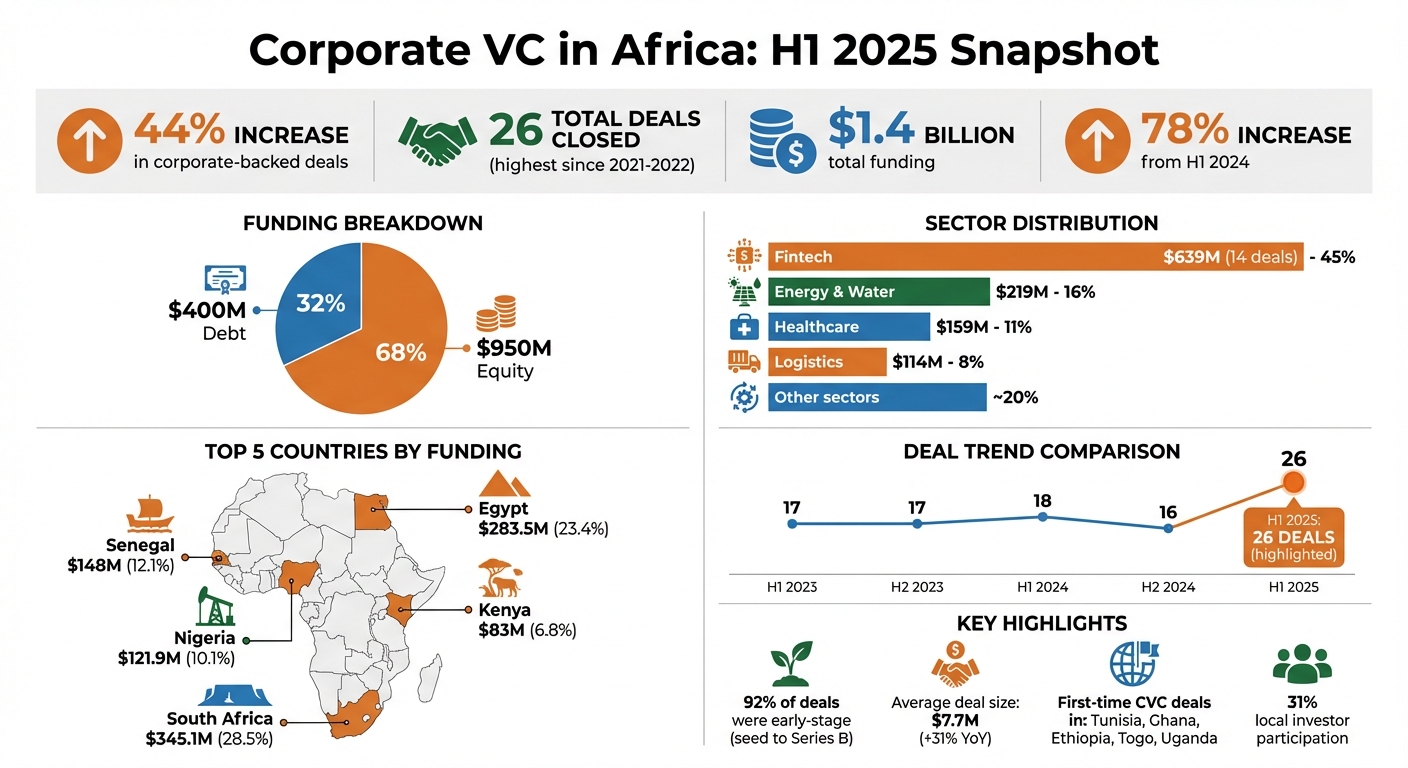

African startups are attracting more corporate venture capital than they have in years. In the first half of 2025, corporate-backed funding surged by 44% compared to H2 2024, with 26 deals closed – the highest since 2021–2022. Total funding reached $1.4 billion, a 78% increase from H1 2024, driven by equity ($950M) and debt financing ($400M). Key highlights include:

- Fintech dominance: $639M raised across 14 deals, with Nigeria leading.

- Sector focus: Energy, healthcare, and logistics followed fintech in funding totals.

- New players: Corporations from India, Japan, and the Middle East entered the market.

- Emerging regions: Countries like Tunisia, Ghana, and Ethiopia secured their first corporate-backed deals.

- Debt financing growth: $137M in debt raised by Senegal’s Wave marked a record.

This growth reflects a shift toward funding startups with proven models, hard-currency revenues, and strategic alignment with corporate investors. The ecosystem is expanding beyond traditional hubs, creating new opportunities for founders and investors alike.

Africa Corporate VC Growth H1 2025: Key Statistics and Sector Breakdown

Does Africa need more corporate VC? #techcabal

H1 2025 CVC Investment Numbers

The first half of 2025 saw corporate-backed funding rounds climb to 26 deals, a 44% jump from the same period in 2024. This surge in corporate venture capital (CVC) activity was a major factor in the region’s funding recovery.

Out of the $1.35 billion in total capital raised, $950 million came from equity investments, while $400 million was secured through debt financing. Corporate venture capitalists took the lead with what many described as “independent conviction”, focusing on startups that aligned with their strategic goals rather than simply following market trends. These numbers provide a strong foundation for exploring the forces behind this growth.

What Drove the Growth?

Three key factors contributed to the 44% uptick:

First, new players from different regions entered the market with significant investments. Corporations from India, Japan, and the Middle East – particularly the UAE, Qatar, and Saudi Arabia – made large-scale commitments. A standout example: MediaTek, the Taiwanese semiconductor company, invested $10 million in Egyptian chipmaker InfinLink. Meanwhile, PepsiCo‘s Kgodiso Fund supported South African agtech startup Khula with $7 million to expand its digital marketplace for farmers.

Second, African corporations began establishing their own venture arms to strengthen supply chains and embrace innovation. Flour Mills of Nigeria joined a $20 million Series A round for OmniRetail in April 2025, leveraging the B2B e-commerce platform to better serve West African retailers. Similarly, Morocco’s OCP Group launched Innovx to fund agtech startups tackling food security challenges. Younes Addou, VP of Agribusiness at Innovx, emphasized the urgency of fostering innovation:

“If we want to reach [small farmers] in a short time we need strong innovation ecosystems.”

Third, the focus shifted from quantity to quality. Investors increasingly prioritized startups with hard-currency revenues, solid unit economics, and annual growth rates exceeding 60%. Strategic partnerships and proven business models took precedence over riskier, experimental ventures. For example, South Africa’s Hollard Group led a $38 million Series B+ round for Naked Insurance, integrating the startup’s technology into its own distribution networks.

How H1 2025 Stacks Up Against Previous Years

Looking at the broader trend, the 26 corporate-backed deals in H1 2025 represent a significant departure from the stagnation seen in 2023 and 2024. The table below illustrates how this period compares to recent half-year cycles:

| Period | Corporate-Backed Funding Rounds |

|---|---|

| H1 2023 | 17 |

| H2 2023 | 17 |

| H1 2024 | 18 |

| H2 2024 | 16 |

| H1 2025 | 26 |

The 44% increase from H1 2024 to H1 2025 marks the strongest performance since the 2021–2022 boom, when global capital poured into African tech. However, the focus has shifted. Corporates are now backing B2B infrastructure like regtech, embedded finance, and trade platforms – areas that address real operational challenges. As Uwem Uwemakpan, Head of Investment at Launch Africa Ventures, put it:

“The companies getting funded aren’t competing in basic payments or lending anymore; they’re building regtech, embedded finance, B2B trade finance infrastructure that benefits from fintech’s maturation.”

This shift is also reflected in deal sizes. The average investment rose 31% year-over-year to $7.7 million, signaling fewer but larger bets on startups with proven models. Overall, startups raised between $1.2 billion and $1.35 billion in H1 2025, an 86% increase from H1 2024, with corporate VCs playing an increasingly prominent role in this growth.

Sectors Attracting the Most CVC Investment

Corporate venture capital (CVC) investors have zeroed in on a few key sectors – fintech, energy, healthcare, logistics, and IT. Together, fintech, energy, and healthcare accounted for a whopping 71% of all funds deployed. This focus highlights a deliberate shift toward industries addressing critical infrastructure issues while also offering clear pathways to profitability.

Fintech led the pack, attracting approximately $639 million across 14 corporate-backed funding rounds. Energy and water ventures secured $219 million, while healthcare drew $159 million. Logistics startups followed with $114 million, largely aimed at modernizing supply chains.

This targeted investment approach was no coincidence. Corporate VCs are increasingly favoring startups that can seamlessly integrate into their operations or solve pressing business challenges. Gone are the days of pouring money into speculative ventures with uncertain returns. Let’s take a closer look at how each sector performed and why they stood out.

Fintech Leads Investment Activity

Fintech not only dominated in terms of funding but also saw a surge in deal activity. The 14 corporate-backed rounds in the first half of 2025 marked a 75% jump from the previous average of eight rounds per half-year. Nigeria emerged as the region’s fintech powerhouse, with startups raising $162.8 million in disclosed deals. Notably, fintech has become a magnet for corporate capital, with eight of Africa’s nine unicorns operating in this space.

One standout deal came in June 2025, when Senegal-based fintech Wave secured $137 million in debt financing, making it the strongest month for debt deals in over two years. Fintech’s proven business models and ability to generate hard-currency revenues have cemented its status as a cornerstone of corporate investment in African startups.

Healthcare and Renewable Energy Growth

Healthcare investments shifted focus to what some call “soft healthcare” – consumer-facing wellness, beauty, and lifestyle products that sidestep the complexities of heavy regulatory oversight. This pivot has made the sector more appealing to corporate investors, offering quicker returns without the red tape associated with traditional health-tech.

Renewable energy and water ventures also attracted considerable attention. Investors see Africa’s infrastructure challenges as opportunities for growth. For example, Tunisian startup Kumulus Water raised $3 million from Belgian mineral water company Spadel to scale its technology that produces drinking water from air. Energy investments centered on practical solutions like mini-grids, pay-as-you-go solar systems, and energy storage – essential tools for corporations operating in areas with unreliable electricity.

Agritech and IT Sector Performance

Agritech has re-entered the spotlight as investors recognize Africa’s untapped potential in addressing global food security. Morocco’s OCP Group launched Innovx to support agritech startups tackling these challenges. Younes Addou, Vice President of Agribusiness at Innovx, highlighted the continent’s strategic importance:

“Africa has the potential to solve global food security problems and become the world’s global carbon sink if the continent’s 270 million small farmers can be connected and mobilised in the right way.”

Meanwhile, IT services have gained momentum, with three corporate-backed funding rounds in the first half of 2025 – up from just one in the previous two half-year periods combined. Egyptian software startup Qme, for instance, secured $3 million from UAE-based IT services firm AHOY to expand its business solutions across North Africa. This growth reflects a growing recognition of the massive opportunity in digitizing Africa’s 600,000 formal firms and 40 million microbusinesses. Affordable, cloud-based software is making it easier for these businesses to streamline operations without significant upfront costs.

Where CVC Investment is Happening

This section dives into the geographic trends of corporate venture capital (CVC) investments during the first half of 2025. The data reveals a mix of continued dominance by well-established markets and exciting activity in newer regions. While traditional investment hubs still claim the lion’s share of funding, emerging markets are beginning to secure deals that seemed unlikely just a few years ago.

Leading Countries for Investment

South Africa emerged as the top destination, attracting $345.1 million in funding, which accounted for 28.5% of the total. Egypt followed with $283.5 million, or 23.4%. Nigeria and Kenya maintained steady performances, drawing $121.9 million (10.1%) and $83 million (6.8%), respectively. Ibrahim Sagna, Executive Chairman of Silverbacks Holdings, highlighted the growing influence of Chinese venture capital in the region:

“Chinese VCs are not very visible from afar; however they are very present, especially in Nigeria”.

Although these established markets continue to dominate, investors are increasingly turning their attention to previously overlooked regions.

New Markets Entering the Scene

For the first time in H1 2025, corporate-backed deals were recorded in Tunisia, Ghana, Ethiopia, Togo, and Uganda. This marks a shift in investor confidence toward opportunities outside the usual hubs. For example, Tunisia’s Kumulus Water secured $3 million from Belgian mineral water company Spadel to expand its air-to-water technology. In Togo, super-app Gozem raised $30 million in a Series B round split evenly between equity and debt. Ghana’s Zeepay also made waves, raising $18 million in venture debt to drive its expansion. These developments underline the growing appeal of these emerging markets.

Country-Specific Investment Figures

Senegal delivered a surprising performance, pulling in $148 million, which represented 12.1% of the continent’s total funding. This was largely driven by Wave’s $137 million debt facility, secured in June 2025 and led by Rand Merchant Bank. This deal not only marked the strongest month for debt financing in more than two years but also signaled that Francophone markets are now producing startups with the scale to attract global investors. Ghana and Togo also posted notable figures, with $39 million and $30 million in total investments, respectively.

Interestingly, multi-region deals saw a sharp decline, making up just 20% of total activity compared to nearly 40% before 2023. This shift reflects a growing preference among investors for more focused, localized investments, emphasizing depth over breadth.

sbb-itb-dd089af

Major Deals and Companies in H1 2025

Largest Funding Rounds

The first half of 2025 saw some standout deals that highlighted the growing dynamism of Africa’s startup scene. Nigerian fintech Moniepoint secured a $110 million Series C round, making it one of only two companies to achieve this funding level during the period. The other Series C deal came from Egypt’s MoneyFellows.

Senegal’s mobile money platform Wave led the way with the largest deal of the period – a $137 million debt facility arranged by Rand Merchant Bank in June 2025. Other notable deals included South Africa’s Naked Insurance, which raised $38 million in a Series B+ round led by Hollard Group, and Togo’s super-app Gozem, which closed a $30 million round.

In a bid to strengthen its supply chain, Flour Mills of Nigeria participated in a $20 million Series A round for OmniRetail, a B2B e-commerce platform targeting West African retailers. Meanwhile, Taiwan’s MediaTek invested $10 million in Egyptian semiconductor startup InfinLink, and PepsiCo’s Kgodiso Fund committed $7 million to South African agritech company Khula. These deals offer a snapshot of the diverse sectors attracting major investments.

Deal Breakdown by Sector

Fintech continued to dominate Africa’s funding landscape in H1 2025, pulling in $639 million – accounting for roughly 45% to 50% of the total deal value. Energy and water-focused startups followed with $219 million, while healthcare ventures attracted $159 million in funding during the same timeframe. Logistics and transport companies raised about $114 million, underscoring the rising interest in technologies that enhance infrastructure and supply chains.

The Seychelles, often seen as a niche player, emerged as a hotspot for crypto-related deals. The jurisdiction recorded 12 corporate-backed investments, eight of which targeted blockchain startups. Notably, Mango Network raised $13.5 million in February 2025 in a round led by crypto exchange KuCoin, which participated in seven of these deals.

In total, African startups closed 26 corporate-backed funding deals in H1 2025 – a 44% jump from the previous high of 18 deals. This increase reflects a shift in investor behavior, moving from exploratory efforts to more strategic investments aimed at securing access to technology, strengthening supply chains, and expanding market reach.

Funding Stages and Ecosystem Development

The recent record-breaking deals highlight a strategic pivot in funding priorities, signaling a move toward creating a more sustainable ecosystem.

Early-Stage Funding Takes the Lead

In the first half of 2025, corporate-backed funding heavily focused on early-stage investments. Of the 26 deals recorded during this period, nearly 92% were aimed at early-stage rounds, including seed and Series B funding. This trend reflects a clear investor preference for nurturing new ventures from the ground up.

Later-stage investments, on the other hand, were rare. Only two companies, Moniepoint and MoneyFellows, managed to secure Series C funding, a level typically reserved for standout performers. Ibrahim Sagna, Executive Chairman of Silverbacks Holdings, shared his perspective:

“The best founders are raising beyond series B. The ones that are fulfilling their promises, maybe it takes a bit longer than usual but they are definitely doing series C and beyond”.

Seed-stage funding saw significant growth, increasing 30% year-over-year to reach $171 million. The average investment size also climbed by 31%, hitting $7.7 million. This shift reflects a growing emphasis on disciplined, sustainable growth strategies. By focusing on early-stage funding, investors are laying the groundwork for alternative financing approaches that support long-term growth.

Emphasis on Profitability and Debt Financing

The funding landscape is evolving, with a stronger focus on quality investments and sustainable growth over rapid scaling.

Debt financing emerged as a key trend, accounting for 28.5% of the total funding in H1 2025. Startups raised $400 million through debt – a 55% increase compared to the previous year. This marks a notable change in how African startups approach capital. Rather than giving up equity at lower valuations, many founders are turning to venture debt to extend their operational runway while retaining control of their companies.

One standout example came in June 2025, when Senegal-based fintech Wave secured a $137 million debt facility led by Rand Merchant Bank to fuel its expansion across Francophone Africa. Similarly, Ghana’s Zeepay raised $18 million in senior secured venture debt to accelerate its growth in Africa and the Caribbean.

Uwem Uwemakpan, Head of Investment at Launch Africa Ventures, highlighted the broader significance of these developments:

“What’s more interesting are the quality signals embedded in these trends that suggest we’re entering a more mature exit environment for seed-stage investments”.

Startups are no longer solely reliant on international venture capital for Series A and B rounds. Instead, they are exploring alternative paths like horizontal consolidation and vertical integration, enabling earlier and more diverse exit opportunities.

What This Means for African Tech

The rise of corporate venture capital is reshaping opportunities for founders, investors, and policymakers across Africa. As the tech ecosystem grows beyond its traditional strongholds, it’s attracting more advanced funding and encouraging regional diversification and targeted investments in key sectors.

Growth Beyond the Big Four Countries

While established markets remain robust, newer regions are stepping into the spotlight with impressive strides. In the first half of 2025, countries like Tunisia, Ghana, Ethiopia, Togo, and Uganda secured their first corporate-backed deals, highlighting that innovation isn’t confined to the usual hubs.

North Africa emerged as a leader in deal volume during early 2025, accounting for 26% of all transactions. Investors are increasingly drawn to these less competitive markets, where groundbreaking ideas are solving local challenges with global potential. At the same time, Southern Africa stood out for attracting larger investments. Despite fewer deals, it secured 25% of total capital, thanks to more mature companies ready to scale. These patterns reveal a fascinating dynamic: certain regions are excelling at early-stage innovation, while others focus on scaling proven models.

Where Investors and Founders Should Look

Three sectors stand out as high-growth opportunities:

- Fintech continues to dominate, capturing between 45% and 60% of all equity funding in H1 2025. However, the real edge lies in addressing specific pain points rather than creating one-size-fits-all platforms.

- Healthcare is shifting toward consumer-friendly wellness, beauty, and lifestyle products. These areas bypass heavy regulatory hurdles, allowing quicker market entry.

- Agritech offers vast long-term promise. For instance, South Africa’s Khula raised $7 million from PepsiCo’s Kgodiso Fund to link farmers with customers through a digital marketplace.

“Africa has the potential to solve global food security problems and become the world’s global carbon sink if the continent’s 270 million small farmers can be connected and mobilized in the right way”

For policymakers, enabling institutional capital is key. Ghana and Nigeria have already updated regulations to allow pension funds to invest in private equity and venture capital, creating steady, local funding sources less reliant on unpredictable foreign capital.

Signs of a Maturing Ecosystem

Several trends indicate that African tech is evolving into a more mature ecosystem.

One major shift is the rise of local investor participation, which grew from 19% a decade ago to 31% in 2024. Local investors bring valuable market insights and a longer-term commitment, offering stability compared to international funds that might pull back during global downturns.

Another sign of maturity is the increase in strategic consolidation. African startups are no longer just acquisition targets – they’re becoming acquirers themselves. Uwem Uwemakpan, Head of Investment at Launch Africa Ventures, noted:

“We’re entering a more mature exit environment for seed-stage investments… successful African startups are now becoming strategic acquirers, not just acquisition targets”

Perhaps the most striking development is the global expansion of African-born companies. Nigerian startup Moove, which began by financing vehicles for Uber drivers, has grown to operate in 29 cities across five continents, managing a fleet of 40,000 vehicles with support from Uber, BlackRock, and MUFG. Similarly, LemFi expanded from addressing Nigerian remittance needs to serving migrants from India, China, and other Asian countries in the UK and US, eventually partnering with Visa. Ibrahim Sagna, Executive Chairman of Silverbacks Holdings, summed it up perfectly:

“African businesses are now themselves projecting outward, leveraging technology, exporting their ideas, culture and services to the rest of the world”

Investor confidence in African startups is also climbing, with the average deal size reaching $7.7 million in 2025 – a 31% increase from the previous year. The growing use of venture debt and a stronger focus on business fundamentals over unchecked growth are further signs of a tech ecosystem built for sustainability and long-term success.

Conclusion

The 44% increase in corporate-backed funding rounds during the first half of 2025 highlights a major turning point in Africa’s tech ecosystem. With total venture capital reaching about $1.42 billion across 243 deals, the continent has shifted from recovery into a phase of strategic and steady growth. Unlike past cycles driven by hype, this period is grounded in proven business models, meaningful partnerships, and a notable rise in local investment – 31% of all active participants are now domestic investors.

This momentum is further supported by diversification across sectors and regions, signaling a broader evolution in Africa’s tech landscape. While fintech still dominates with 45% of total funding – amounting to $639 million – new sectors like healthcare, renewable energy, and agritech are emerging as strong contenders. The fact that countries such as Tunisia, Ghana, Ethiopia, Togo, and Uganda secured their first corporate-backed deals in H1 2025 underscores that opportunities are no longer confined to traditional tech hubs.

To capitalize on these trends, founders should aim to collaborate with corporate investors who bring not just funding but also market access and operational expertise. For investors, the focus should shift to solving pressing challenges in infrastructure, energy, and logistics instead of backing non-essential solutions. Meanwhile, policymakers must continue to pave the way for institutional capital by implementing regulatory reforms, following examples set by Ghana and Nigeria, where pension funds are now allowed to invest in private equity.

Perhaps the most striking sign of progress is the way African startups are now exporting technology globally, rather than solely addressing local markets. Companies like Moove, which operates in 29 cities across five continents with support from Uber and BlackRock, prove that African innovation can thrive on the global stage. With venture debt providing founders with non-dilutive funding options, the ecosystem is equipped for sustained growth.

The combination of strong fundamentals, growing momentum, and expanding opportunities sets the stage for stakeholders to create lasting value across the continent.

FAQs

What caused the rise in corporate venture capital funding in Africa during the first half of 2025?

Corporate venture capital (CVC) investments in Africa reached their highest point in three years during the first half of 2025, driven by a mix of strategic goals and economic shifts. Big-name corporations are increasingly backing African startups to access expanding markets and take advantage of cutting-edge technologies. Sectors like fintech, healthcare, and renewable energy are leading the charge, offering opportunities to broaden digital payment systems, enhance healthcare accessibility, and address sustainability targets.

African startups secured $1.35 billion in funding during H1 2025 – a massive 78% jump compared to the previous year. Local investors now account for 31% of the venture capital on the continent, reflecting a more developed ecosystem. This maturity not only attracts corporate co-investment but also helps mitigate risks. Together, these factors – strategic corporate interests, increased funding, and growing local investor participation – have driven corporate VC investments in Africa to impressive new levels.

What industries are attracting the most corporate venture capital in Africa?

Fintech, healthcare, and renewable energy are leading the way as the most attractive industries for corporate venture capital in Africa. These sectors are expanding quickly, driven by their ability to tackle pressing issues like improving financial access, enhancing healthcare quality, and shifting toward cleaner energy solutions.

This wave of investment highlights increasing trust in African startups and their capacity to spark innovation and fuel economic growth across the region.

How are less-established regions in Africa benefiting from the rise in corporate venture capital?

The first half of 2025 saw a remarkable surge in corporate venture capital (CVC) investments, reaching a three-year high. During this period, startup funding across emerging African markets climbed to about $1.35 billion – a 78% jump compared to the previous year. What’s notable is how this capital is now spreading beyond well-established hubs like Lagos and Nairobi to newer ecosystems, including Accra, Kigali, Addis Ababa, and Dakar.

These emerging regions are reaping substantial rewards. CVC investments are delivering more than just money – they’re opening doors to strategic partnerships that bring expertise, distribution networks, and added credibility. Key industries like fintech, healthcare, and renewable energy are thriving, fueling job creation and unlocking new opportunities for local entrepreneurs. Beyond that, the ripple effects are evident in the growth of support services, such as legal firms and talent-development agencies, which are helping startups scale more efficiently and attract additional funding.

This wave of corporate-backed investment is reshaping African markets, turning them into lively hubs of innovation. It’s driving economic diversification and creating pathways for broader job growth across the continent.

Related Blog Posts

/* Shares”}};

/* ]]> */