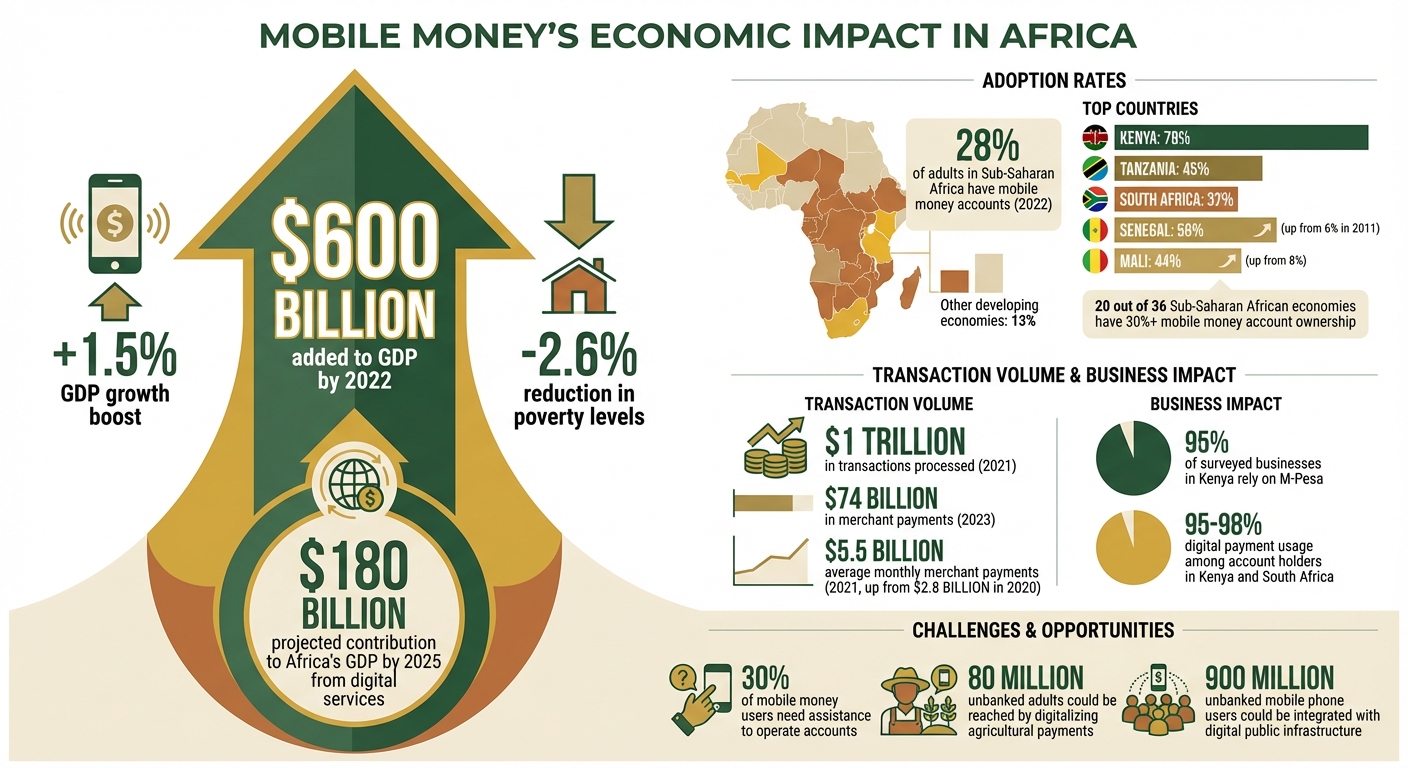

Mobile money is transforming economies in Africa, driving growth and expanding access to financial services. By 2022, 28% of adults in Sub-Saharan Africa had mobile money accounts, surpassing traditional banking in many regions. This shift has fueled GDP growth, reduced poverty, and connected millions to the formal economy.

Key takeaways:

- Economic Impact: Mobile money added $600 billion to GDP by 2022, boosting growth by 1.5%.

- Adoption Rates: Kenya leads with 79% account ownership, while Senegal and Mali saw rapid adoption growth.

- Business Benefits: Platforms like M-Pesa enable faster, safer transactions, with 95% of surveyed businesses in Kenya relying on it.

- Challenges: Digital literacy and smartphone access remain barriers, but digitizing payments could bring 80M unbanked adults into financial systems.

Mobile money is reshaping financial access, offering a path to economic growth and opportunity across Africa.

Mobile Money’s Economic Impact in Africa: Key Statistics and Growth Metrics

Africa Perspectives: Digital Payment Innovations in Sub-Saharan Africa

Measuring Mobile Money’s Impact on GDP Growth

The numbers don’t lie – mobile money is playing a significant role in Africa’s economic growth. By the end of 2022, the adoption of mobile money services boosted the GDP of participating countries by 1.5%, contributing nearly $600 billion to their economies. Studies highlight that mobile money adoption has a direct, measurable effect on long-term economic growth in low- and middle-income countries, with benefits that persist over time. Let’s dive into the countries leading this transformation and how mobile money is amplifying economic progress.

Countries Leading Mobile Money Adoption

Some African nations are setting the pace for mobile money adoption, and the economic impact is undeniable. By integrating previously excluded individuals and businesses into the formal financial system, these countries are reducing transaction costs and providing access to credit for investments.

Kenya stands out as a trailblazer, with 79% of its population owning accounts, largely driven by mobile money services. Tanzania follows at 45%, and South Africa reports 37% adoption. Even more impressive, 20 out of 36 surveyed Sub-Saharan African economies boast mobile money account ownership rates of 30% or more, far exceeding the 13% average in other developing economies. Digital payment usage among account holders in Kenya and South Africa is also remarkably high, ranging from 95% to 98%. These widespread adoption rates are fueling the high transaction volumes that contribute significantly to economic growth.

Transaction Data and Economic Contributions

The sheer scale of mobile money transactions underscores its economic importance. In 2021, mobile money platforms processed around $1 trillion in transactions. Merchant payments alone saw massive growth, averaging $5.5 billion per month in 2021 – up from $2.8 billion in 2020. These platforms now handle a variety of complex transactions, including merchant payments, bill settlements, and international remittances.

The ripple effects are profound. Mobile money adoption has been linked to a 2.6% reduction in poverty levels. Additionally, digital services – strongly supported by mobile money – are projected to contribute $180 billion to Africa’s GDP by 2025. Clearly, mobile money is not just a financial tool; it’s reshaping economic opportunities and driving growth across the continent.

Mobile Money Success Stories Across Africa

M-Pesa: Transforming Payments in Kenya

M-Pesa has had a profound impact on Kenya’s economy. Since its launch in 2007, the platform quickly gained traction, attracting 9 million customers – equivalent to 40% of Kenya’s adult population – within just three years. By 2022, M-Pesa had helped lift around 194,000 Kenyan households, roughly 2% of the population, out of poverty by boosting per capita consumption levels.

“Mobile financial services platforms like M-Pesa are vital drivers of financial inclusion in society which can improve individual life chances and enable enterprises to launch and expand, bringing wealth and jobs into developing economies.” – Sitoyo Lopokoiyit, CEO of M-Pesa Africa

M-Pesa’s impact extends beyond simple transactions. It has empowered female-headed households to transition from subsistence farming to running businesses. In Kenya, where the platform is well-established, 11% of adults now rely on mobile money accounts for borrowing, compared to just 4% who use traditional banks or microfinance institutions. By 2010, M-Pesa was already handling more domestic transactions within Kenya than Western Union was managing globally. Its success has become a blueprint for similar platforms fostering economic growth across Africa.

Other Platforms Expanding Access in West and East Africa

While M-Pesa led the way in East Africa, other mobile money platforms have driven remarkable progress across the continent. In Senegal, mobile money adoption propelled account ownership from just 6% in 2011 to an impressive 56% by 2022. Mali experienced a similar transformation, with account ownership rising from 8% to 44%. Even more strikingly, the platform helped narrow the gender gap in account ownership, reducing it from 20 percentage points in 2017 to only 5 percentage points by 2021.

These stories underscore the growing influence of mobile money in reshaping financial access and economic opportunity across Africa.

sbb-itb-dd089af

Policy and Infrastructure Supporting Mobile Money Growth

How Regulatory Frameworks Enable Mobile Money Adoption

Regulatory frameworks play a critical role in the growth of mobile money. Countries that permit non-bank providers – especially Mobile Network Operators (MNOs) – to deliver financial services have experienced the fastest adoption rates. Allowing MNOs to participate introduces competition that traditional banks often cannot match, creating a more dynamic financial ecosystem.

Interoperability is another cornerstone of success. Over 90 markets now allow cross-platform transfers, enabling seamless transactions between different providers. Additionally, tiered identity verification systems have opened the doors for millions of people who lack traditional forms of documentation to access mobile money services. These regulatory measures are key to advancing digital financial inclusion. Successful frameworks also mandate that providers hold 100% of customer funds in fully regulated banks, ensuring both financial stability and room for innovation.

In Togo, for example, 40% of adults now receive government payments directly into mobile money accounts, significantly driving adoption. At the same time, consumer protection measures, such as transparent fee structures and effective dispute resolution mechanisms, are becoming increasingly important. As mobile platforms expand, the risks of fraud and identity theft grow, making these protections essential.

While supportive regulations have laid the groundwork for mobile money’s adoption, challenges and opportunities remain for scaling these services further.

Barriers and Opportunities for Scaling Mobile Money

Despite the progress, several obstacles hinder mobile money’s full potential. Sitoyo Lopokoiyit, CEO of M-Pesa Africa, highlights these challenges:

“There remains though barriers both to accessing platforms – including digital literacy and smartphone accessibility – and to developing them – with an un-level regulatory playing field for non-traditional financial services providers in many countries”.

Digital literacy is a significant hurdle. In Sub-Saharan Africa, 30% of mobile money users cannot operate their accounts without help, with the figure climbing to 46% in Malawi. Limited access to smartphones and the lack of government-issued IDs further restrict account ownership.

However, these challenges also present opportunities. For instance, digitizing agricultural payments could bring over 80 million unbanked adults into the formal financial system, as many still receive payments in cash. Kenya offers a glimpse of what’s possible – 54% of agricultural payment recipients already use mobile money, while another 25% receive payments through bank accounts, showing that the transition is within reach.

Success stories from other regions further illustrate the potential. In Rwanda, public–private partnerships helped increase 4G users from 500,000 to 5 million between 2023 and 2025. Programs like the Digital Ambassadors Program connected 1,000 health facilities and 4,000 schools, broadening access to mobile money services. In Ghana, the mobile money sector saw transaction values soar to GH¢1.912 trillion in 2023 – a 78.7% increase from the previous year – thanks to a network of 228,000 agents who brought financial services to remote areas.

These examples highlight both the challenges and the transformative potential of scaling mobile money systems worldwide.

Conclusion: Mobile Money’s Future in Africa’s Economy

Mobile money has reshaped Africa’s economy in profound ways. Over a decade, from 2012 to 2022, it contributed an estimated $600 billion to the continent’s GDP. This growth spurred annual per capita income increases by 1 percentage point and helped reduce poverty levels by 2.6%.

The industry is evolving into a more integrated platform model, offering services like merchant payments, international remittances, bill payments, and bulk disbursements. In 2023 alone, merchant payments surged by 14%, reaching nearly $74 billion. This shift is creating new opportunities for businesses and consumers alike, but it also highlights the importance of strong digital infrastructure to sustain this momentum.

Building digital public infrastructure is critical for advancing financial inclusion. Tools such as digital IDs and instant payment systems – akin to India’s UPI or Brazil’s PIX – could integrate 900 million unbanked mobile phone users into formal financial systems. Bill Gates, Chair of the Gates Foundation, underscored this potential, stating:

“The case for investing in inclusive financial systems, digital public infrastructure, and connectivity is clear – it’s a proven path to unlocking opportunity for everyone”.

Despite these advancements, challenges remain. Around 30% of mobile money users in Sub-Saharan Africa still need assistance navigating these systems. Additionally, digitalizing agricultural payments could bring financial services to more than 80 million unbanked adults. As regulatory policies mature and digital literacy improves, mobile money is poised to further strengthen Africa’s financial systems, driving inclusivity and resilience across the continent.

FAQs

How does mobile money boost economic growth in Africa?

Mobile money has become a major driver of economic growth across Africa, significantly boosting financial inclusion and streamlining transactions. Research highlights a clear connection between the use of mobile money services and increased GDP. In fact, these platforms have contributed approximately $600 billion to local economies over the last decade.

By lowering transaction costs, mobile money makes it easier for small businesses and informal traders to accept payments and expand their customer base. It also opens doors to credit and savings, helping households invest in assets or better manage their expenses. On top of that, international remittances are processed more quickly and at a lower cost, channeling additional income into local communities. These combined advantages fuel business growth, enhance financial systems, and support long-term economic development across the continent.

What obstacles are preventing mobile money from reaching more people?

Mobile money services, while transformative, face several hurdles that limit their reach and inclusivity. For starters, high transaction fees and account maintenance costs often put these services out of reach for low-income users. On top of that, strict Know-Your-Customer (KYC) and anti-money laundering (AML) regulations can exclude individuals who lack formal identification, leaving many without access.

In rural areas, the challenge grows even steeper. Limited agent networks make it difficult for users to handle basic cash-in and cash-out transactions. Add to this the issues of poor network coverage, unreliable electricity, and limited internet access, and it becomes clear why mobile money struggles to gain a foothold in remote regions.

Trust is another critical factor. Concerns about data privacy and insufficient consumer protection measures can deter potential users. And then there’s the gap in financial education. Without robust financial literacy programs or targeted outreach – especially for women and underserved communities – many remain unaware or unable to fully engage with these services.

If mobile money is to truly thrive and serve everyone, these barriers need to be addressed. The focus must shift to creating solutions that work not just for urban and affluent users, but for those in the most underserved and remote areas as well.

How do regulatory policies support the growth of mobile money services?

Regulatory policies are shaping the expansion of mobile money by ensuring a secure and trustworthy environment for users and providers alike. Some of the key steps include implementing clear Know-Your-Customer (KYC) guidelines, setting balanced anti-money laundering (AML) and counter-terrorism financing rules, and establishing reasonable transaction limits. These measures not only protect consumers but also encourage small-scale transactions, making mobile money more accessible.

Policymakers are also prioritizing safeguards such as capital adequacy standards, proper management of customer funds, and strict oversight of agent networks. This ensures that agents are well-trained and reliable, which is essential for building trust. Additionally, consumer protection rules – like dispute resolution systems and data privacy measures – are being embedded to further enhance confidence, especially among underserved communities. These efforts are helping to boost mobile money adoption and contribute to economic growth.

The impact is clear: countries with well-structured and supportive policies tend to see greater mobile money usage and even measurable improvements in GDP. This balanced regulatory approach is enabling mobile money platforms to scale effectively across Africa, advancing financial inclusion and driving economic development.

Related Blog Posts

/* Shares”}};

/* ]]> */