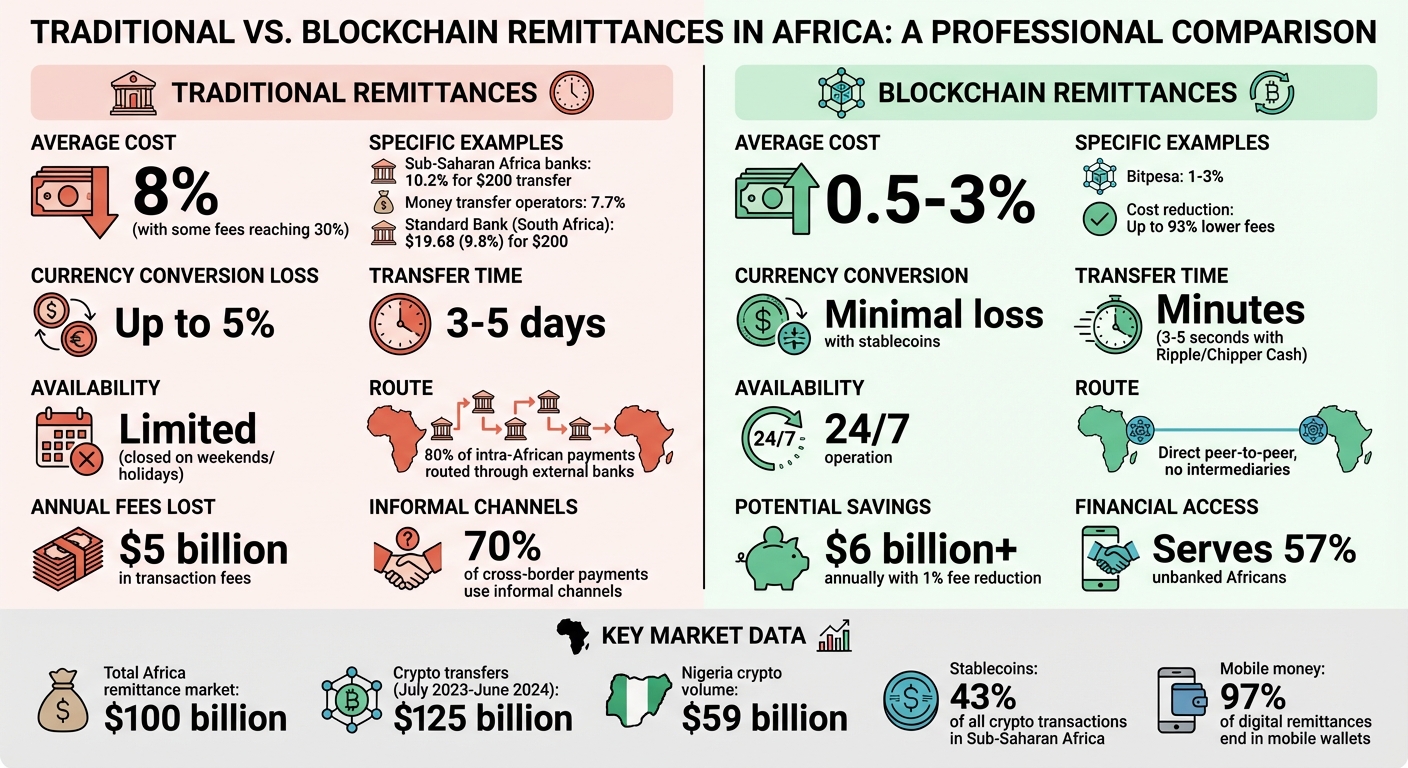

Blockchain is transforming Africa’s $100 billion remittance market by slashing costs, speeding up transfers, and expanding financial access.

Here’s what you need to know:

- High remittance fees and delays: Sending money to Africa costs an average of 8%, with some fees reaching 30%. Transfers often take 3–5 days. These inefficiencies push 70% of cross-border payments into informal channels, risking financial security and transparency.

- Blockchain’s advantages: Blockchain reduces fees to 0.5–3%, processes payments in minutes (even on holidays), and ensures secure, transparent transactions. It also enables financial access for the 57% of Africans who are unbanked, leveraging mobile technology instead of traditional banking.

- Growing adoption: Platforms like Bitpesa and Chipper Cash are using blockchain to cut costs and improve speed. Stablecoins like USDC are gaining traction, especially amid local currency depreciation. Key partnerships, such as Onafriq with Circle, are connecting millions of wallets and bank accounts across Africa.

- Regulatory progress: Countries like Nigeria and Kenya are introducing blockchain policies, while regional initiatives like the African Continental Free Trade Area (AfCFTA) aim to harmonize digital payment systems, reducing reliance on external banks.

Blockchain is not just a tool for cheaper remittances – it’s reshaping financial systems, making them more accessible and efficient for millions across Africa.

Traditional vs Blockchain Remittances in Africa: Cost, Speed, and Access Comparison

How Blockchain Cuts Costs and Speeds Up Transfers

Lower Transaction Fees

Blockchain technology is reshaping the cost structure of money transfers, particularly in regions like Africa, where financial inclusion is critical. By cutting out intermediaries like correspondent banks, blockchain enables direct peer-to-peer transactions, drastically reducing fees. To put this in perspective, traditional banks in Sub-Saharan Africa charge an average of 10.2% for a $200 transfer, while money transfer operators charge around 7.7%. Blockchain platforms, on the other hand, typically charge between 1% and 3%, slashing fees by up to 93%.

For example, sending $200 through Standard Bank in South Africa costs about $19.68 (9.8%), but using blockchain platforms like Bitpesa reduces that to just 1% to 3%. Stephany Zoo, Head of Marketing at Bitpesa, highlights this advantage:

Our fees are 1 to 3%, so it’s significantly lower than those mentioned in the World Bank report. A lot of our clients are money transfer operators that actually move the money and we are the underlying technology.

Currency conversion is another area where blockchain shines. Traditional transfers can lose as much as 5% of their value during conversion, but stablecoins offer a direct digital alternative, minimizing these losses. Even a modest 1% reduction in global remittance fees could save senders over $6 billion annually. Beyond the cost savings, blockchain also brings speed to the table.

Faster Payment Processing

Speed is another major advantage of blockchain-based remittances. Ripple’s partnership with Chipper Cash in March 2025 is a case in point. By integrating Ripple Payments into its platform, Chipper Cash – serving 5 million customers – now processes transactions in just 3 to 5 seconds, with cross-border payments settling in mere minutes. Reece Merrick, Ripple‘s Managing Director for the Middle East and Africa, explained:

By integrating our technology into Chipper Cash’s platform, we’re enabling faster, more affordable cross-border payments while driving economic growth and innovation.

Unlike traditional banks that close on weekends and holidays, blockchain networks operate 24/7. In October 2025, Deel, a global payroll platform, introduced stablecoin payouts for international contractors. This update allowed payments to be completed in minutes rather than days, sidestepping the usual settlement delays.

Better Transparency and Security

Beyond cost and speed, blockchain enhances transparency and security in financial transactions. Its immutable ledger creates a public, unalterable record where users can track who settled a trade, at what rate, and how profits were distributed. Features like smart contracts and escrow services add another layer of protection, ensuring funds are only released when specific conditions are met.

This level of transparency also prevents manipulation, such as small groups colluding to fix exchange rates – a common issue in traditional remittance systems. Blockchain’s neutral and secure infrastructure ensures fairness and builds trust among users, making it a game-changer for global payments.

sbb-itb-dd089af

Blockchain Remittance Platforms Operating in Africa

Zone‘s Blockchain Infrastructure

Zone, previously known as Appzone, introduced Africa’s first layer-1 regulated blockchain network specifically designed for fiat payments. This innovation is reshaping how remittances are handled. Unlike conventional systems that rely on centralized switches, Zone directly connects financial institutions through a peer-to-peer mesh network. By June 2024, nine Nigerian banks, including four of the country’s top five, had already adopted the network, which was processing transactions across more than 6,000 ATMs.

Fast forward to April 2025, Zone had processed transactions worth 1 trillion Naira (approximately $636 million) across 100 million transactions, achieving an impressive 99.99% success rate. The platform utilizes all four daily settlement windows, enabling same-day settlements – a significant improvement over the traditional 24-hour settlement cycle. In March 2024, Zone raised $8.5 million in seed funding, co-led by Flourish Ventures and TLcom Capital, aimed at expanding its blockchain infrastructure. These advancements have set the stage for further developments in blockchain technology, supported by strategic partnerships.

Olayiwola Osoba, Zone’s VP of Marketing and Corporate Communications, shared insights into the platform’s success:

The driving force behind this acceptance is twofold: First, the regulatory landscape is evolving positively… Second, banks and businesses are seeing firsthand the benefits of decentralised payment infrastructure – lower costs, fraud mitigation, and improved service reliability.

Onafriq–Circle Partnership Using USDC

On April 30, 2025, Onafriq teamed up with Circle to integrate USDC into its network, spanning 40 African markets. This collaboration addresses a major issue: 80% of intra-African payments are routed through banks outside the continent, resulting in approximately $5 billion in transaction fees annually. Onafriq’s network connects 1 billion mobile money wallets and 500 million bank accounts, offering a more streamlined alternative.

The depreciation of Nigeria’s naira by over 100% in 2024 further boosted interest in stablecoins. By October of that year, stablecoins accounted for 43% of all crypto transactions in Sub-Saharan Africa. Dare Okoudjou, Onafriq’s Founder and CEO, highlighted the partnership’s potential:

By integrating USDC, we aim to simplify financial transactions for institutions and individuals, reduce costs, and strengthen trust. This collaboration underscores our vision to democratise access to payments and drive financial inclusion across the globe.

This move not only reduces transaction fees but also reinforces blockchain’s growing influence in transforming Africa’s remittance systems.

Other Blockchain Remittance Platforms

Other platforms are also leveraging blockchain to improve remittance services across Africa. Yellow Card and Due, for instance, use stablecoins like USDC and USDT to facilitate faster and more affordable cross-border transactions while helping users shield themselves from local currency fluctuations. Mori Sylla, Due‘s West Africa Commercial and Operations Lead, explained:

Stablecoins solve multiple pain points in cross-border transactions. They’re faster, cheaper, and still connected to familiar systems like bank accounts and mobile money wallets.

Flutterwave has also joined the movement, piloting a program that allows merchants to use USDC for cross-border payments on the Polygon blockchain. Meanwhile, NALA secured approval from the Bank of Ghana to launch remittance services in partnership with BigPay, enabling seamless payments for individuals and businesses in Ghana.

Nigeria’s eNaira, the Central Bank Digital Currency, operates on a private blockchain powered by Hyperledger Fabric. It supports peer-to-peer transfers and government-to-citizen payments, although its adoption has been slow. These examples highlight how blockchain technology is being used to cut costs and speed up transactions, offering a glimpse into the evolving remittance landscape in Africa.

Regulations and Policies Supporting Blockchain Remittances

National Blockchain Policies

In May 2023, Nigeria introduced its National Blockchain Policy, which lays out a structured framework covering areas like a national consortium, legal guidelines, digital identity, education, business incentives, and a testing sandbox. Chimezie Chuta, the Founder of the Blockchain Nigeria User Group, highlighted its importance:

The policy document provides a clear regulatory framework that outlines the rules, guidelines, and standards for the blockchain and crypto industry. This clarity helps businesses and individuals understand their rights, responsibilities, and compliance requirements.

Kenya is also moving in a similar direction. By late 2024, the country began developing a detailed regulatory framework for crypto assets and Virtual Asset Service Providers (VASPs), aiming for full implementation by April 2025. Kenya’s crypto adoption is already notable, ranking 21st out of 155 countries in the Global Crypto Adoption Index and 3rd globally for peer-to-peer exchange trade volume in 2024.

Licensing and Compliance Requirements

In December 2023, the Central Bank of Nigeria (CBN) reversed its 2021 “crypto ban” by issuing the “Guidelines on Operations of Bank Accounts for Virtual Assets Service Providers.” This change allows regulated financial institutions to offer banking services to registered VASPs. Prior to this, the SEC had already established rules in May 2022 for digital asset issuance and custody, creating a registration framework for VASPs.

These platforms are required to link customer accounts to BVN (Bank Verification Number) and NIN (National Identification Number) while adhering to anti-money laundering laws and the Nigeria Data Protection Act (NDPA) 2023. In February 2025, Nigeria also launched Africa’s first regulated Naira-backed stablecoin, cNGN, under the oversight of the SEC. This initiative simplifies compliance for users. By February 4, 2025, there were 4,400 cNGN stablecoins in circulation, held by seven users. Together, these licensing steps align with broader regional efforts to enhance cross-border integration.

AfCFTA’s Role in Cross-Border Integration

These regulatory developments are paving the way for regional cooperation in digital payments. In February 2024, the African Continental Free Trade Area (AfCFTA) adopted its Protocol on Digital Trade, introducing harmonized rules to facilitate digital payments across Africa. Article 15 of the Protocol specifically calls on member states to ensure interoperability between their digital payment systems, which is essential for blockchain-based remittances. The framework also supports cross-border electronic KYC verification, open APIs, and regulatory sandboxes to test new technologies.

The Pan-African Payment and Settlement System (PAPSS) plays a central role in achieving AfCFTA’s objectives. It enables cross-border transactions in local currencies without relying on external banks. Previously, 80% of intra-African payments were routed through banks outside the continent, leading to $5 billion in annual transaction fees. PAPSS now allows individual customers to transact up to $20,000 per quarter, while Authorized Dealer Banks have a higher limit of $200,000 per quarter.

The Role of Stablecoins & Blockchain in Africa Cross Border Trade & Remittance

Blockchain’s Effect on Remittance Growth and Financial Access

Blockchain technology is reshaping the way remittances work and opening up financial opportunities for people who were previously excluded from traditional systems.

Rising Remittance Volumes

Africa’s remittance market continues to grow and has become a crucial part of the continent’s economy. Cristina Duarte, United Nations Special Adviser on Africa, highlighted the importance of these funds:

For many, they [remittances] are the difference between survival and destitution, between going to bed on an empty stomach and having a meal.

Blockchain is speeding up this growth by making remittance services cheaper and more accessible. Between July 2023 and June 2024, Sub-Saharan Africa received an estimated $125 billion in cryptocurrency transfers, a $7.5 billion increase compared to the prior year. Nigeria alone accounted for $59 billion, placing it second in global cryptocurrency adoption. Ethiopia also stood out, with its retail-sized stablecoin transfers growing by an impressive 180% year-over-year.

Growth in Crypto and Mobile Money Usage

Stablecoins now make up about 43% of all crypto transactions in the region. They offer a practical solution during foreign exchange crises, acting as a substitute for the U.S. dollar when local currencies lose value. Chris Maurice, CEO and Co-Founder of Yellow Card, explained the benefit:

Stablecoins provide an opportunity for these businesses to continue to operate, grow, and strengthen the local economy.

Using stablecoins for remittances is also far more affordable. Sending $200 via stablecoins costs about 60% less than traditional methods. Mobile money platforms have played a key role in this shift. In 2022, 97% of digital remittances processed by networks like TerraPay ended up in mobile wallet accounts. These platforms cater to smaller, more frequent transactions; for instance, 35% of digital remittances received via mobile wallets were for amounts below $50. This approach not only cuts costs but also provides financial options to underserved communities.

Expanding Financial Access

In Sub-Saharan Africa, where only 49% of adults had a bank account in 2021, blockchain is breaking down barriers. With just a smartphone and internet access, people can bypass traditional banking hurdles like extensive paperwork and limited branch networks. Rob Downes, Head of Digital Assets at Absa CIB, explained how blockchain is creating new financial opportunities:

In financial services, the rich data that exists on businesses and individuals… can be combined with new sources (digital wallets, mobile money) to create new models for assessing risk and therefore build access to finance and credit.

This combination of data not only helps financial institutions serve previously excluded groups but also builds trust through transparency. As more people adopt these tools, the perception of cryptocurrency is evolving. Moyo Sodipo, COO and Co-founder of Busha, noted:

People are starting to see the real-world utility of cryptocurrency, especially in day-to-day transactions, which is a shift from the earlier view of crypto as just a get-rich-quick scheme.

Sub-Saharan Africa now leads the world in decentralized finance (DeFi) adoption. This surge is driven by the demand for accessible services like interest-earning accounts and lending options that traditional systems have struggled to provide.

The Future of Blockchain in African Remittances

Blockchain is rapidly reshaping Africa’s remittance market, emerging as a key financial backbone. Between 2020 and September 2025, the supply of stablecoins surged from $5 billion to an impressive $305 billion. By 2030, these digital currencies are expected to account for 20% of the global cross-border payments market. Chris Harmse, Co-Founder and Chief Business Officer at BVNK, highlighted the significance of this shift:

Blockchain and stablecoins are the biggest infrastructure upgrade to payments in decades.

Beyond simple money transfers, blockchain is evolving to support more advanced systems. Future developments will likely integrate blockchain ledgers with AI-powered fraud detection and automated smart contracts. Rob Downes, Head of Digital Assets at Absa CIB, envisions this transformation:

It certainly isn’t farfetched to see a future world where digital money lives on blockchains, with AI tooling monitoring real time activity and patterns to detect and prevent fraud.

The modernization of payment systems is already underway, with over ten African nations actively exploring or rolling out Central Bank Digital Currencies (CBDCs).

However, challenges persist. Cash remains dominant across the continent, with only 5–7% of transactions being digital. Regulatory inconsistencies across borders and limited internet access in rural areas further complicate adoption. Simplifying blockchain’s complexity for everyday users is a crucial next step.

Despite these obstacles, blockchain’s role in Africa’s financial future is clear. It is poised to strengthen regional trade under the African Continental Free Trade Area (AfCFTA) by lowering costs for small businesses and improving cross-border liquidity. A growing trend among remittance providers is the “stablecoin sandwich” model – converting local currency into stablecoins for instant cross-border transfers, then back into the recipient’s local currency. This approach is becoming a standard practice, solidifying blockchain’s position in the transformation of Africa’s $100 billion remittance market.

FAQs

How does blockchain help lower remittance costs in Africa?

Blockchain technology has transformed how money is sent to Africa by doing away with the need for traditional intermediaries like banks and money transfer services. Instead, it enables transactions to be handled directly on decentralized networks, which operate with greater speed and efficiency.

Without these middlemen, the usual fees – often averaging about 8.37% – can drop to just a tiny fraction of that amount. This shift makes blockchain a game-changer for providing affordable remittance services, offering a lifeline to millions across the region who depend on these money transfers.

How are stablecoins transforming remittances in Africa?

Stablecoins are changing the game for remittances in Africa, providing a fast, affordable, and dependable alternative to traditional money transfer systems. Tied to the U.S. dollar, they eliminate the steep fees and delays that often come with conventional banking or remittance services.

Thanks to blockchain technology, stablecoins facilitate nearly instant cross-border transactions while keeping their value steady. This makes them a lifeline for millions of Africans who need to send or receive money internationally, particularly in areas where affordable financial services are hard to come by.

How are new regulations shaping blockchain adoption in Africa?

Recent regulatory updates across Africa are shaping a clearer and more reliable landscape for blockchain and cryptocurrency use, particularly within remittance services. In Nigeria, for example, the Investments and Securities Act now officially recognizes virtual assets, requiring exchanges to secure licenses to operate. Similarly, countries like Ghana and Kenya are rolling out frameworks to regulate platforms and enforce compliance.

These changes are minimizing risks for businesses and attracting companies like Blockchain.com to expand their presence in the region. However, the introduction of stricter measures – such as mandatory Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, along with tax reporting requirements – has increased operational costs. This has led smaller startups to join forces with licensed providers to stay competitive. As governance becomes more defined, blockchain technology is gaining momentum in remittance services, enabling faster, safer, and more accessible cross-border transfers for millions of Africans and their families.

Related Blog Posts

/* Shares”}};

/* ]]> */