Ripple USD (RLUSD) is reshaping financial transactions in Africa by addressing two key challenges: currency instability and high cross-border payment costs. RLUSD is a stablecoin pegged 1:1 to the U.S. dollar, offering a reliable alternative to volatile local currencies and expensive remittance systems.

Key highlights:

- Fast, low-cost payments: RLUSD enables near-instant cross-border transactions at a fraction of traditional banking fees.

- Regulatory backing: Issued by a New York trust company, RLUSD is overseen by the NYDFS, ensuring compliance and transparency.

- Widespread use: Platforms like Chipper Cash and Yellow Card have integrated RLUSD, making it accessible for businesses and individuals.

- Real-world impact: From remittances to SME treasury management, RLUSD is simplifying financial operations and reducing risks tied to currency fluctuations.

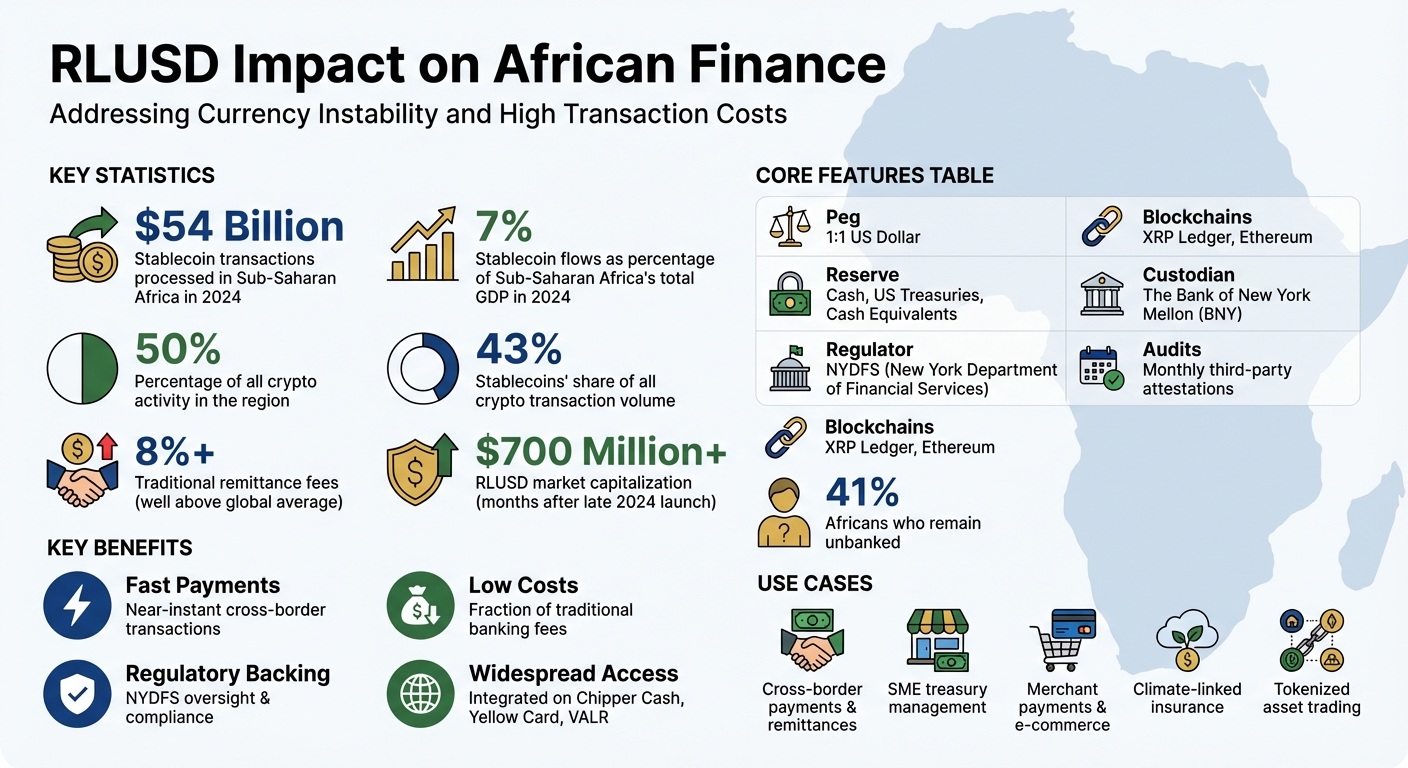

With $54 billion in stablecoin transactions processed in Sub-Saharan Africa in 2024 and remittance fees often exceeding 8%, RLUSD is emerging as a practical solution for businesses and families alike.

RLUSD Impact on African Finance: Key Statistics and Benefits

🌍 Ripple Expands Nigeria Boundaries | Africa Stablecoin Rollout Accelerates

What Is RLUSD and Why It Works for Africa

RLUSD is making waves in African economies by addressing key financial challenges through its stable and secure design. Let’s take a closer look at how RLUSD operates and why it’s a game-changer for the region.

How RLUSD Works

RLUSD is a stablecoin tied directly to the U.S. dollar at a 1:1 ratio. For every RLUSD token, there’s an equivalent dollar safely held in reserve. These reserves consist of cash, U.S. Treasuries, or cash equivalents, all stored in segregated accounts. The Bank of New York Mellon acts as the primary custodian, ensuring the stablecoin maintains its dollar value – an essential feature in regions prone to currency fluctuations.

To reinforce this stability, RLUSD follows strict regulatory guidelines. It has received approval from the Dubai Financial Services Authority (DFSA), and Ripple provides monthly third-party attestations to confirm that each token is fully backed by liquid reserves. This transparency is especially important for businesses adhering to compliance standards.

RLUSD operates across two major blockchains: the XRP Ledger and Ethereum. This dual compatibility increases access to liquidity and decentralized finance (DeFi) applications. It’s used for various functions, including cross-border payments, treasury management, and as collateral for trading tokenized assets like securities and commodities.

| Feature | Ripple USD (RLUSD) |

|---|---|

| Peg | 1:1 US Dollar |

| Reserve Composition | Cash, US Treasuries, Cash Equivalents |

| Primary Regulator | NYDFS (New York Department of Financial Services) |

| Blockchains | XRP Ledger, Ethereum |

| Primary Custodian | The Bank of New York Mellon (BNY) |

| Audit Frequency | Monthly third-party attestations |

This combination of technical features and robust oversight makes RLUSD a reliable option for stabilizing financial transactions, particularly in Africa.

Benefits of RLUSD for African Economies

African economies often grapple with volatile local currencies and high costs for cross-border payments. RLUSD offers a solution by providing a stable currency alternative that shields businesses from devaluation risks and simplifies international trade with predictable pricing.

One of RLUSD’s standout features is its ability to facilitate near-instant, low-cost cross-border transactions. This speed and affordability are game-changers for small and medium-sized enterprises (SMEs) managing tight cash flows, as well as for individuals relying on remittances. Reduced transaction costs mean more money stays in the hands of those who need it most.

A notable example of RLUSD’s potential came in September 2025, when Mercy Corps Ventures piloted a drought and rainfall insurance program in Kenya. The initiative used RLUSD to automate payouts through smart contracts, triggered by satellite data. Ripple supported the effort with a $25,000 contribution.

“RLUSD has quickly become established in enterprise financial use cases, from payments to tokenization to collateral in both crypto and traditional trading markets”, said Jack McDonald, SVP of Stablecoins at Ripple.

RLUSD’s strong compliance framework further enhances its appeal for African financial technology platforms. With its rigorous regulatory backing, banks and payment processors are more likely to adopt RLUSD, paving the way for partnerships and innovations in the region’s financial ecosystem.

What’s Driving RLUSD Adoption in Africa

Payment Challenges and Currency Volatility

African businesses and households face two persistent financial struggles: high remittance fees and volatile local currencies. Sub-Saharan Africa is one of the priciest regions globally for international payments, with traditional banking fees often exceeding 8% – well above the global average. For families relying on remittances from abroad, these high costs eat into money meant for essentials like food, education, and healthcare.

Currency instability only adds to the burden. In countries such as Nigeria, the naira’s frequent fluctuations erode purchasing power. This has fueled demand for USD-backed assets, which help preserve value and offer more predictable pricing for trade. Traditional methods for cross-border settlements are not only slow but also expensive, leaving African institutions with limited access to stable and reliable funds.

In 2024, Sub-Saharan Africa processed around $54 billion in stablecoin transactions, representing nearly 50% of all crypto activity in the region. This highlights a growing appetite for faster and more cost-effective alternatives to conventional banking. RLUSD directly addresses these issues by enabling near-instant settlements at significantly lower costs, all while maintaining a dollar peg that safeguards value. These factors make RLUSD a natural fit for Africa’s evolving financial ecosystem.

How RLUSD Fits Africa’s Fintech Ecosystem

Tackling these financial challenges calls for innovative fintech solutions, and RLUSD has found a strong foothold in Africa’s dynamic fintech landscape. High transaction fees and currency volatility have created fertile ground for RLUSD’s growth, supported by partnerships with platforms like Chipper Cash, VALR (South Africa’s largest crypto exchange), and Yellow Card (a pan-African payment platform launched in September 2025). These collaborations make RLUSD accessible to both institutions and everyday users across multiple African countries, simplifying treasury management and cross-border payments.

What sets RLUSD apart isn’t just its availability – it’s also its regulatory credibility. African fintechs increasingly favor “compliance-first” stablecoins, and RLUSD’s regulation by the New York Department of Financial Services (NYDFS) provides the trust and security that businesses and users need.

As Chris Maurice, CEO and Co-founder of Yellow Card, noted: “Our customers demand access to stable digital assets that are useful for secure cross-border payments and treasury management. Offering a regulatory-compliant stablecoin like RLUSD is a natural step”.

How African Businesses Use RLUSD

Cross-Border Payments and Remittances

African businesses are increasingly using RLUSD to sidestep the delays and high costs associated with traditional bank transfers. Legacy banking systems often take days to process cross-border payments, while RLUSD transactions are completed in seconds. Additionally, remittance fees in Africa can climb to nearly 10% per transaction, but RLUSD significantly reduces these costs by cutting out intermediaries. For overseas workers sending money home or businesses paying international vendors, this efficiency translates into substantial savings.

In April 2025, Ripple teamed up with Chipper Cash to integrate Ripple Payments into their platform. By September 2025, this partnership expanded to include RLUSD, enabling Chipper Cash’s institutional and SME clients to benefit from faster and cheaper cross-border payments. These improvements not only save time and money but also provide a reliable foundation for better financial planning, especially for small businesses.

SME Treasury and Financial Stability

For small and medium-sized enterprises (SMEs) across Africa, managing finances can be a challenge due to local currency depreciation and inflation. RLUSD offers a practical solution by maintaining its peg to the US dollar, even when local currencies experience dramatic fluctuations. Many SMEs now allocate a portion of their reserves to RLUSD, helping them hedge against inflation, stabilize supplier payments, ensure consistent employee compensation, and maintain more predictable budgets.

What makes RLUSD particularly appealing is its regulatory backing. Issued by a New York limited-purpose trust company and overseen by the NYDFS, RLUSD provides the transparency and trust needed for institutional-level financial operations. Beyond serving as a reserve asset, RLUSD is also used as collateral for trading tokenized assets like commodities and securities.

Merchant Payments and E-Commerce

Merchants across Africa are incorporating RLUSD into their payment systems to simplify B2B transactions and expand their reach in international trade. The stablecoin enables instant cross-border settlements, eliminating the multi-day delays that can disrupt business operations. For e-commerce platforms working with global partners, RLUSD serves as a dependable bridge between local currencies and the digital economy. Merchants can hold funds in RLUSD to avoid currency volatility and convert to local money only when necessary.

A 2025 survey revealed that 64% of finance leaders in the Middle East and Africa cited faster settlements and lower transaction costs as the main reasons for adopting blockchain-based currencies in their payment systems. This shift demonstrates the growing importance of digital currencies like RLUSD in modernizing commerce and financial management across the region.

sbb-itb-dd089af

How to Build with RLUSD: A Guide for Startups

Integration Options and Technical Requirements

RLUSD runs on the XRP Ledger (XRPL) and Ethereum blockchains, so your platform must be compatible with at least one of these networks. For many African startups, the quickest route involves leveraging Ripple Payments. This enterprise-grade solution simplifies cross-border transfers, offering near-instant and low-cost transactions without requiring you to build everything from the ground up.

Another option is to collaborate with platforms already providing RLUSD liquidity. This approach allows you to focus on developing your core product while utilizing RLUSD’s capabilities. Beyond basic integration, RLUSD can support advanced functionalities like parametric insurance and escrow services.

For startups exploring more complex applications, RLUSD can work with smart contracts to enable automatic payouts based on external triggers. A compelling example comes from a pilot project launched by Mercy Corps Ventures in Kenya in September 2025. This initiative used RLUSD to fund drought insurance, automatically disbursing payments to farmers when satellite data confirmed drought conditions. Ripple contributed 25,000 RLUSD to the program, supplementing $12,000 provided earlier by Mercy Corps Ventures and Arbitrum.

Regulatory Compliance and Risk Management

One of RLUSD’s strengths lies in its solid regulatory foundation, which provides startups with a built-in compliance advantage. Issued by a New York limited purpose trust company and regulated by the NYDFS, RLUSD operates on infrastructure that meets institutional-grade standards. However, it’s essential to comply with local Virtual Asset Service Provider (VASP) laws to ensure legal clarity.

When Yellow Card integrated RLUSD in September 2025, CEO Chris Maurice emphasized the importance of offering a regulatory-compliant solution for treasury management and cross-border payments. RLUSD’s monthly audits and oversight by the NYDFS further enhance its credibility, making it easier to gain user trust and satisfy regulatory requirements.

“RLUSD was created with trust, utility, and compliance at its core, and backed by Ripple’s many years of experience working with both crypto and traditional finance.” – Team Ripple

This strong regulatory framework not only fosters trust but also sets the stage for designing user-friendly products, as detailed below.

Designing User-Friendly Products with RLUSD

With RLUSD’s robust technical and regulatory foundation, the focus should shift to creating products that are fast, transparent, and easy to use. Highlight RLUSD’s features like instantaneous settlement in your product design. Clearly communicate its 1:1 backing to the U.S. dollar and its regulatory compliance to set it apart from other, more volatile crypto assets.

Ease of use is critical, especially when facilitating seamless transitions between fiat and crypto. Users should be able to move funds in and out of RLUSD without requiring technical expertise. Features like automated exchanges or recurring purchase options can help users manage currency volatility and build savings over time. For the 41% of Africans who remain unbanked, RLUSD offers a digital alternative to cash, making simplicity and accessibility key design priorities.

“Our customers demand access to stable digital assets that are useful for secure cross-border payments and treasury management. Offering a regulatory-compliant stablecoin like RLUSD is a natural step in our mission to deliver trusted, enterprise-grade solutions.” – Chris Maurice, CEO and Co-Founder, Yellow Card

What’s Next for RLUSD and African Fintech

Regulatory Trends and Market Changes

In Africa, regulations are increasingly leaning toward stablecoins that prioritize compliance, and RLUSD is positioned right at the heart of this shift. Its backing by a trust company regulated by the New York Department of Financial Services (NYDFS) gives it an edge over unregulated competitors. This credibility is crucial, especially when you consider that stablecoin flows in Sub-Saharan Africa accounted for nearly 7% of the region’s total GDP in 2024, with stablecoins making up 43% of all crypto transaction volume.

Trident Digital Tech Holdings (TDTH) is actively collaborating with African regulators and financial institutions to secure stablecoin licenses, aiming for a phased rollout of RLUSD operations across multiple markets by mid-2026. To fuel this expansion, TDTH announced a $500 million fundraising initiative in late 2025. The funds will support the creation of a corporate XRP treasury to address local liquidity issues and streamline cross-border payments. Additionally, the Dubai Financial Services Authority’s (DFSA) regulatory approval for RLUSD sets a strong example for aligning international standards in emerging markets.

Global regulations, such as Europe’s Markets in Crypto-Assets (MiCA) framework, are also influencing African policymakers to favor regulated stablecoins. RLUSD’s transparent reserves, institutional-grade infrastructure, and regulatory compliance make it an appealing choice for fintechs and enterprises in Africa looking for reliable digital asset solutions. Companies like VALR and Yellow Card are already prioritizing compliance-driven assets to meet the needs of institutional clients. This regulatory momentum paves the way for meaningful growth opportunities for startups across the continent.

Growth Opportunities for Startups

One of the most immediate opportunities lies in the remittance sector. Sub-Saharan Africa is among the most expensive regions for sending remittances, with fees often surpassing 8%. By integrating RLUSD, startups can bypass traditional banking systems, enabling faster and cheaper transfers. RLUSD’s rapid adoption – reaching a market capitalization of over $700 million just months after its late 2024 launch – underscores its potential. Startups targeting high-fee remittance corridors can provide immediate value to users while building scalable business models.

Another promising area is climate-linked finance. In September 2025, Ripple partnered with Mercy Corps Ventures in Kenya to launch a parametric insurance pilot for farmers. The program, funded with 25,000 RLUSD, uses smart contracts to automatically release payments when satellite data confirms extreme weather events. Startups can replicate this approach in agriculture, livestock management, and disaster relief, creating new opportunities to address pressing challenges.

“RLUSD is uniquely positioned to drive institutional use of blockchain technology across Africa and broader global markets, including through cross-border payments.”

- Ham Serunjogi, Co-Founder & CEO, Chipper Cash

Treasury management for SMEs is another area ripe for growth. With foreign exchange shortages becoming a recurring issue, businesses are increasingly turning to stablecoins as substitutes for scarce U.S. dollars to keep trade operations running. Startups can develop tools to help SMEs hold RLUSD as a safeguard against local currency devaluation. Ripple’s $200 million acquisition of Rail, a company specializing in business-to-business stablecoin transactions, and its $1.25 billion acquisition of Hidden Road, a global credit network, further expand the infrastructure available for fintechs to build upon.

Finally, startups can delve into on-chain settlement and tokenization, using RLUSD as collateral for trading tokenized real-world assets such as commodities and securities. By partnering with established regional players like Chipper Cash, VALR, and Yellow Card, startups can tap into existing RLUSD liquidity and scale faster.

Conclusion: How RLUSD Can Transform African Finance

RLUSD offers a practical solution to Africa’s challenges with currency instability and high transaction costs. By introducing a stable, USD-pegged alternative to volatile local currencies, it helps businesses and individuals safeguard against inflation and currency risks. The growing adoption and impressive transaction volumes highlight its potential to reshape financial systems in the region.

In 2024, Sub-Saharan Africa processed around $54 billion in stablecoin transactions, which accounted for nearly half of all crypto activity in the area. This is particularly significant when compared to traditional remittance fees that often exceed 8%. RLUSD provides a faster and more affordable option, offering real benefits to families and businesses trying to navigate these financial hurdles.

What sets RLUSD apart is its strong regulatory foundation and reliable infrastructure. Issued by a New York limited purpose trust company and regulated by the NYDFS, RLUSD is designed to meet the needs of both enterprises and regulators. This stability translates into meaningful economic opportunities. Beyond simple transactions, RLUSD supports small businesses with treasury management, enables climate insurance for at-risk farmers, and opens doors to tokenized asset trading.

Its real-world impact is already evident. RLUSD facilitates cross-border financial products that help mitigate currency risks and create accessible solutions for those excluded from traditional banking systems. With its robust design and forward-thinking applications, RLUSD is well-positioned to reshape financial interactions across Africa in the years to come.

FAQs

How does Ripple USD (RLUSD) remain stable despite currency fluctuations in African markets?

Ripple USD (RLUSD) stays steady by being fully backed by U.S. dollars kept in a separate reserve of cash and cash equivalents. This setup guarantees that every RLUSD token is redeemable 1:1 for U.S. dollars, shielding it from the ups and downs of fluctuating local currencies.

By tying its value directly to the U.S. dollar, RLUSD offers a reliable and consistent choice for cross-border payments and financial operations, especially in areas where currencies may be unstable.

How are platforms like Chipper Cash and Yellow Card helping drive RLUSD adoption in Africa?

Platforms like Chipper Cash and Yellow Card are making Ripple USD (RLUSD) more accessible to people across Africa. By integrating RLUSD into their services, these platforms allow users – whether individuals or businesses – to send, receive, and settle payments in a stable, dollar-pegged digital currency, all without requiring them to adopt entirely new systems.

For instance, Chipper Cash has added RLUSD to its cross-border payments app, streamlining international transactions to make them faster and more affordable. Meanwhile, Yellow Card has included RLUSD on its cryptocurrency exchange, enabling users to trade the stablecoin alongside other digital currencies. These integrations tackle issues like currency instability, lower transaction fees, and promote greater financial access, offering a practical tool for entrepreneurs, startups, and everyday consumers throughout the region.

How does RLUSD’s regulatory framework make it a trusted choice in African markets?

RLUSD places a strong emphasis on regulatory compliance, making it a dependable choice for users across Africa. It is issued by a licensed trust company based in New York and is overseen by the New York Department of Financial Services (NYDFS). This oversight ensures that RLUSD meets stringent legal and financial requirements, including regular audits, segregation of reserves, and strict anti-money-laundering (AML) protocols. Each RLUSD token is fully backed by U.S. dollar reserves, giving users the assurance that it can always be redeemed 1:1 for USD.

For fintech platforms in Africa, this regulatory framework provides significant advantages. It minimizes risks, streamlines compliance with cross-border AML and Know Your Customer (KYC) rules, and facilitates smoother onboarding of financial institutions. With RLUSD, businesses can execute secure and efficient transactions, whether for high-value remittances, treasury management, or tokenized asset trading. This not only supports financial inclusion but also strengthens trust within the region’s expanding fintech ecosystem.

Related Blog Posts

/* Shares”}};

/* ]]> */